What are Tax Incentives?

Tax incentives are economic vehicles offered by municipalities and states to ideally stoke development in places where it otherwise wouldn’t happen.

The most common form of these in STL are:

Tax Abatement—Property taxes are frozen at pre-development levels. Statutorily capped at 100% for 10 years, with a possible 50%/5 year extension. Special cases allow for longer terms at 100%.

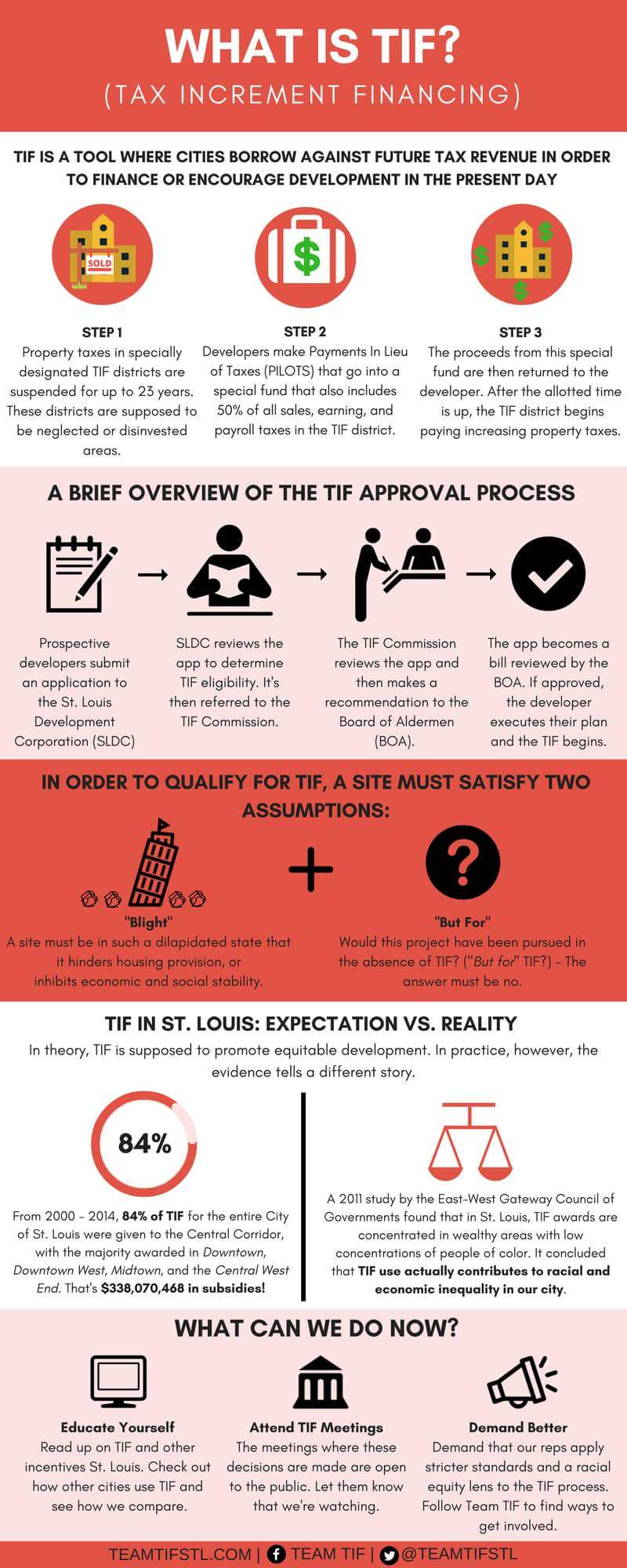

TIF-A portion of any of the following taxes (or a combination thereof) generated by the development are diverted from the general revenue fund to pay back the portion of construction costs financed by the TIF.

- Property tax

- Sales tax

- Earnings tax

This is done in a “pay as you go” fashion, until the costs are paid back, at which point the TIF is over.

CID-Community Improvement District. This is a special taxing district, where a property owner (or group of owners) can get special permission to institute an additional property tax, sales tax, or a combination of both, in a given area. Ideally, these funds are then used to better the area covered by the CID. Recently in STL City, developments have been granted site-specific CIDs, where the tax goes straight back to that single development to use as it sees fit.

Questions to Ask

Planning on attending a hearing concerning TIF or tax abatement? (Or tweeting about one?) Here are some questions you may want to ask. Which of these questions do you think are the most important? What additional questions would you add to this list?

Getting Information

Read up on Sunshine requests here (sometimes information isn’t exactly forthcoming).