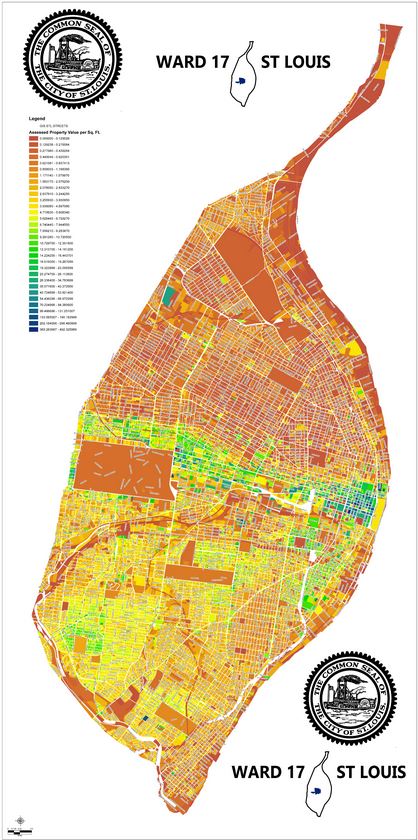

Courtesy of 17th Ward Alderman Joe Roddy’s website, and created by Jonathan Ferry of SLDC: a map of all assessed property value within the City of St. Louis.

Assessed value is the number used to figure out the amount of property tax you pay. The assessed value is typically a percentage of the Appraised (or Market) Value of the property. Commercial and residential property have different assessment rates:

Commercial=32% of market value

Residential=19% of Market Value

That assessed value is then divided by 100 and multiplied by the taxe rate for that year to arrive at your property tax bill for the year. (Assessed value / 100 * tax rate = estimated taxes)

A more complete explanation can be found on the Assessor’s Office website.

The map is not download-able, so we can’t post it independently here , but click on the picture itself to go through to the source page on Alderman Roddy’s website.

*Note: Just because a property has an assessed value does not mean it is assessed taxes at the full rate. Many large institutions in the City are tax-exempt and pay no property tax. Additionally, properties that are tax abated pay at a reduced rate, properties that are part of a TIF development may make payments in lieu of taxes (PILOTs), and properties which are part of a TDD or CID may have an additional property tax levied on them on top of the normal rate.